What is a mobile robot? A mobile robot is a robot capable of moving from one place to another. They are utilized to transfer materials in factory settings relieving employees from burdensome and time-consuming tasks.

Is Mobile Robot an Industrial Robot?

In general, industrial robots are robots used for manufacturing purposes. They are intended mostly to replace human employees in performing difficult, hard-labor, or repetitive tasks. In this sense, mobile robots are part of industrial robots although applications of mobile robots can also be found outside the manufacturing industries.

Industrial Mobile Robot (IMR) is the term used to describe a mobile robot platform equipped with a robotic arm and programmed to perform tasks in industrial settings. The mobile platform would maneuver its robotic arm to pick up and put down items between points of operation.

IMRs found some of their earliest practical applications in warehouse and logistics settings. They are programmed to be able to navigate through the warehouse, retrieve items from inventory shelves, and drop the items at the packaging station.

Fixed Robots vs. Mobile Robots

Most of the robots available today are stationary or fixed, especially when we talk about industrial robots. These robots are the backbone of many industrial processes, and they perform well in doing repetitive tasks.

However, in recent years, we are witnessing a shift to mobile robots, automatic robots that are capable of moving around in their environment. Around 43% of robots nowadays are capable of mobility.

Two Common Categories of Industrial Mobile Robots: AGV and AMR

Automated Guided Vehicle (AGV) and Autonomous Mobile Robot (AMR) are great examples of mobile robotics and are usually mentioned when talking about industrial mobile robots. Both technologies are common fixtures in big factories and warehouses. They both can accomplish similar tasks, which are moving materials around. However, there are apparent differences between the two.

Automated Guided Vehicle (AGV)

Some people think of AGV as the predecessor of mobile robots, and it has been used in industrial settings since the 1950s.

AGV operates on a fixed route, relying on guidance devices such as wire, magnetic tape, laser path, or reflective markers. Changing or adding the routes of AGV can be complex and costly as it would mean changing the infrastructure. The installation will also take more time since the infrastructure needs to be provided before AGV can operate.

AGV is considered to have basic, simple technology. It can detect obstacles but has no ability to change its course of action. As a result, AGVs may become “stuck” when they come across an object along their path. This often requires the help of an operator to move the object and restart the AGV again.

Autonomous Mobile Robot (AMR)

AMR is the newer, smarter, and more expensive technology compared to AGV. It is equipped with an autonomous navigation system within its software. They can overcome obstacles as they can remap and define a new destination.

Although AMR is more expensive than AGV, its installation is fast, easy, and cost-effective. In addition, it offers greater flexibility as it can work in different locations, not bound by any fixed infrastructure. AMR can also be used outside of a building and has a “follow me” application that can be used to follow humans around while carrying loads of material.

Shipment of AGVs and AMRs

According to Interact Analysis, in 2022, over 120,000 Automated Guided Vehicles (AGVs) and Autonomous Mobile Robots (AMRs) were shipped, and this figure is expected to increase annually, driven by the expansion of e-commerce and the transition towards flexible manufacturing.

Confirming these numbers, Market Research Future provided estimates closely aligned with these figures. 116,500 units of AGVs and AMRs combined were dispatched in 2022, according to the firm analysis. Out of that, 68,600 units were AGVs, accounting for 59% of total shipment, while AMRs made up the remaining 41%, amounting to 48,000 units.

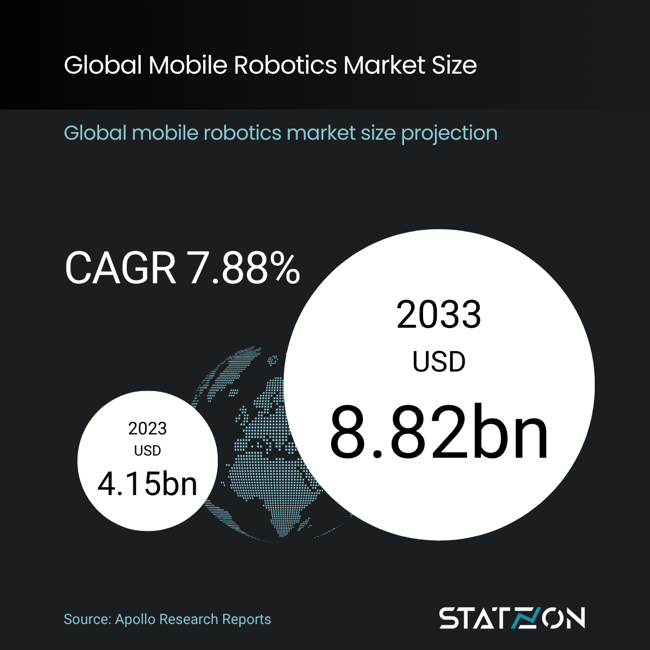

Mobile Robot Market Size

Apollo Research Reports evaluated the global market for mobile robots at an estimated USD 4.2 billion in 2023. Despite the mobile robot market being well-established, it is set for further expansion driven by increasing manufacturing automation. The market value is projected to reach USD 8.8 billion within a decade, growing at a CAGR of 7.9%.

Most mobile robots in the market are powered by lithium-ion batteries, representing 33.3% of the market share in 2023. With a value of USD 1.384 billion in the same year, this segment is expected to grow to USD 3.1 billion by 2033, achieving a CAGR of 8.37%. Subsequently, nickel-based batteries accounted for 22% of the market, while lead batteries had a 14% share, and other types of batteries made up 30.8% of the market.

Factors Contributing to Mobile Robot Market Growth

High personnel costs and wage rates are especially high in developed countries, making automation the key focus in the manufacturing and logistics sectors. Growth in e-commerce is the main driver for AGV/AMR demand in warehouse automation. Major e-commerce companies have increased their acquisitions of robots to boost their warehouse operations.

Advancements in mobile technology and artificial intelligence are already revolutionizing how industries operate. For example, the rightPick robot that was launched in 2017 is able to pick items at a rate of 500 to 600 per hour, on par with a human worker. This kind of technological advancement will further accelerate the growth of the mobile robot market.

Many other factors play a key role in the growth of the market. Many emerging countries are now more willing to justify the cost of mobile robot installations as they have been proven to improve the speed and quality of production. Increasing governmental initiatives in funding and research in robotics will also further fuel the market.

Mobile Robot Market Share by Application

Mobile robots’ applications span a broad spectrum of industries such as logistics, education, entertainment, healthcare, domestic, agriculture, and even the military. The logistics segment takes up the largest share (26%) of the market, based on data by Next Move Consulting Strategy. The use of mobile automated guided vehicles (AGVs) is prominent in this sector to transport goods around warehouses and storage facilities. Notably, the military and entertainment industries also represent significant market segments for mobile robots, holding 13% and 11% of the market share, respectively.

The domestic segment, holding around 9% of the market, is expected to grow significantly. The robots used in this sector are service robots mainly used for household chores. Robots currently available in this segment are, for example, floor cleaners, lawnmowers, swimming pool cleaners, gutter cleaning robots, and telepresence robots.

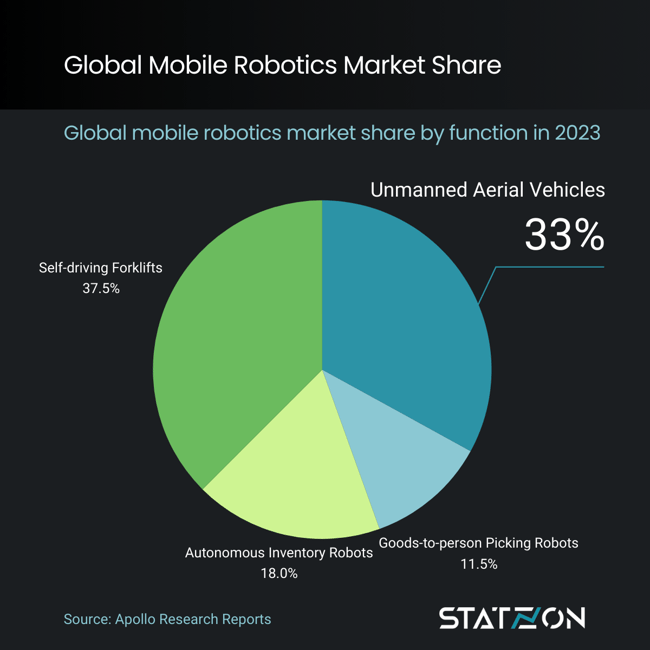

Mobile Robot Market Segmented by Function

Market Research Future segmented the mobile robot market by four different functions including self-driving forklifts, autonomous inventory robots, goods-to-person picking robots, and unmanned aerial vehicles (UAVs), all contributing to a collective market value of USD 4.2 billion.

Self-driving forklifts had the largest share, making up about 37.5% of the market with a valuation of USD 1.559 billion, projected to grow at a CAGR of 8.01% to reach USD 3.351 billion by 2033.

Autonomous inventory robots, occupying the second-largest segment with an 18% market share and a 2023 valuation of USD 750 million, are anticipated to grow at a rate of 7.56%, achieving a value of USD 1.5 billion by 2033.

Goods-to-person picking robots represented 11.5% of the market, valued at USD 478.4 million, and are expected to grow at a CAGR of 6.99%. Lastly, UAVs accounted for nearly 33% of the market, with a value of USD 1.372 billion and a CAGR of 8.18%.

Top Mobile Robot Companies

The mobile robot market is highly competitive, with many manufacturers pursuing different strategies and initiatives in R&D, product launch, partnership, and collaboration. In addition, the promising growth of the market has resulted in numerous new start-ups entering the market, making competition even more fierce. Next Move Research Consulting recognizes KUKA, Northrop Grumman, iRobot, Lockheed Martin, Honda Motor, Kongsberg Maritime, Samsung Electronics, Amazon Robotics, and Softbank Robotics as major players among others. Keep it mind that Amazon produces mobile robots exclusively for its own internal use and does not offer them for sale to external parties.

Interact Analysis has been closely monitoring the diverse and expanding mobile robot market for years, noting its wide array of forms, technologies, and applications across numerous sectors. This variety leads to a fragmented industry, constantly welcoming new entrants.

Significant growth has been seen among AMR startups, with Locus Robotics reaching a valuation of USD 1 billion in 2021, becoming the industry's first unicorn. Geek+, another notable company, is rumored to be planning an IPO, showcasing the progress of these once-emerging players.

While there has been some consolidation, such as MiR's merger with Teradyne in 2022, the industry largely remains independent. The variety in the mobile robot industry covering numerous robot types and applications, contributes to this lack of consolidation. A company's success often hinges more on its industry niche than on its strategy or products due to the vast diversity in the market. Essentially, each company rides a unique wave, with varying outcomes.

Interact Analysis also highlights some of the key players in the field, including KION, JBT, Siasun, Seegrid, HikRobot, Daifuku, Omron, and Jaten, further underscoring the industry's breadth and potential.

Sources: Statzon, Apollo Research Reports study on mobile robot market, Market Research Future study on mobile robot market, Mobilerobotguide, Robotnik.eu, Interact Analysis