In the robotics industry, there are two main categories: industrial robots and service robots. Industrial robots, established since the 1970s, are predominantly used in manufacturing for tasks like assembly and welding. They automate repetitive tasks, enhancing efficiency and safety in production environments.

Service robots, however, are a more recent innovation and serve a different purpose. They are designed not for manufacturing but to assist and interact with humans. Defined as system-based, autonomous interfaces, service robots perform various tasks across multiple sectors. In healthcare, they assist in surgeries; in retail and hospitality, they enhance customer service; and in logistics, they handle deliveries.

What sets service robots apart is their advanced technology, including AI and machine learning, which enable them to adapt and make autonomous decisions. While their designs vary, most are mobile and equipped for lighter tasks compared to the more robust industrial robots.

As technology evolves, the lines between these two types of robots are blurring, but the fundamental distinction remains: industrial robots focus on automating manufacturing processes, while service robots are geared towards improving human-centric services in various industries.

Professional Vs. Consumer Service Robots

The International Federation of Robotics (IFR) categorizes service robots into two main segments: professional service robots and consumer service robots, each serving distinct markets and purposes. In 2022, the professional service robot sector witnessed a significant surge, with sales reaching 158,000 units, marking a 48% increase from the previous year. This growth is largely attributed to the increasing shortage of staff in various industries, prompting companies to turn towards automation as a viable solution. The demand for these robots is further fueled by a lack of skilled workers and a shortage of applicants for service jobs. Reflecting this growing demand, the IFR has identified almost 1,000 suppliers globally, delivering a wide range of autonomous services through professional service robots. These robots are designed for specific, often complex tasks in various professional settings, including healthcare, logistics, agriculture, and more, requiring a high degree of technical sophistication and reliability.

In contrast, the consumer service robot segment caters to a mass market, significantly differing from its professional counterpart. In 2022, sales in this segment reached approximately 5.1 million units, dwarfing the 158,000 units sold for professional use. This segment is primarily driven by the increasing consumer demand for domestic household robots, with about 4.9 million units sold in 2022 alone. The most popular application within this category is indoor domestic floor cleaning, accounting for around 2.8 million units. Robot vacuums, for instance, have become a common fixture in private households for many years. Despite some cyclical volatility, the IFR's statistical department anticipates growth potential in the low double-digit range over the next few years. These consumer robots are designed for ease of use, affordability, and everyday convenience, focusing on tasks like cleaning, lawn mowing, and personal assistance, making them an integral part of modern household management.

Service Robots Market Size

There's a widely acknowledged expectation of significant growth in the global robotics market, with projections indicating substantial expansion across various segments. BCG analysis predicts the market could reach between $160 billion and $260 billion by 2030. In this burgeoning market, professional service robots are expected to capture a market share of up to $170 billion, while industrial and logistics robot sales are projected to peak at around $80 billion.

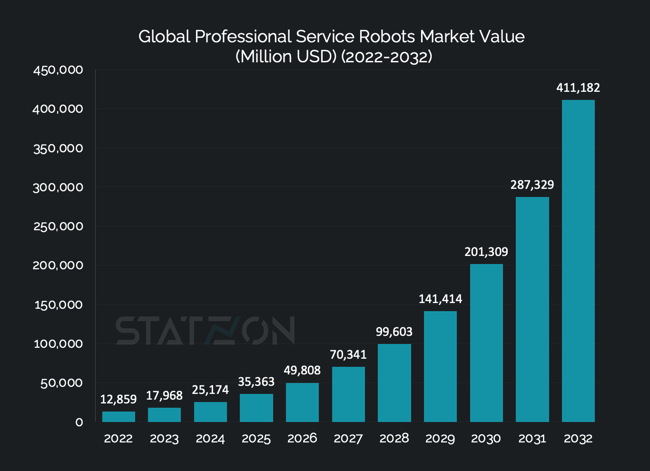

Apollo Research Reports offers an even more optimistic forecast, anticipating the market for professional service robots to escalate from USD 12.8 billion in 2022 to USD 201 billion by 2030, and further to USD 411 billion by 2032. This growth represents a staggering 40.6% CAGR, significantly outstripping the industrial robot segment, which is expanding at a rate of 9.39% annually.

Source: Statzon/ Apollo Research Reports

Source: Statzon/ Apollo Research Reports

Service robots are becoming increasingly vital in sectors like healthcare and hospitality, particularly in response to staff shortages. Research indicates a potential shortfall of 355,000 paid care workers by 2040 in the US alone. In places like Japanese care homes, service robots are already making an impact, assisting with routine tasks such as lifting and transporting residents, and monitoring for falls or emergencies.

The market outlook for professional service robots is robust, as highlighted by the International Federation of Robotics (IFR), which has identified nearly 1,000 service robot suppliers worldwide delivering autonomous services. According to the latest IFR World Robotics Report, 2022 sales numbers for service robotics reveal an optimistic trend.

Mobile robot solutions in transportation and logistics have carved out a strong market share. In 2022, this segment saw a growth of 44%, with sales of more than 86,000 units. Notably, there was a significant increase in sales of robots designed for collaborative indoor environments, reaching nearly 37,300 units.

The hospitality industry is also witnessing a rise in robot adoption, with sales exceeding 24,500 units in 2022, a 125% increase. Many of these robots are being utilized for tasks like food and beverage delivery in restaurants.

In the medical robotics field, there was a slight dip in overall sales, with a 4% decline leading to about 9,300 units sold. However, the surgical robot market experienced a growth of 5%, with nearly 4,900 units sold. Conversely, the market for robots in rehabilitation and non-invasive therapy applications saw a decrease of 16%, falling to less than 3,200 units.

Overall, the service robot market is experiencing an upward trend, driven by technological advancements and a growing demand across various industries. This growth underscores the increasing importance of robotics in meeting critical needs and enhancing efficiency in diverse sectors.

Humanoid Robot

The use of humanoid robots in the service industry is a topic of growing interest, with research indicating both positive and negative impacts on consumer perception and interaction. Studies suggest that anthropomorphism in service robots can enhance user involvement, leading to more positive emotions and stronger trust from consumers. This increased level of anthropomorphism is linked to higher adoption intentions and expectations of better service quality. For instance, when robotic chefs are anthropomorphized, people tend to expect better food quality. Additionally, human-like service robots using human-like language styles are often evaluated more positively in service encounters, as consumers expect them to behave in a human-like manner.

Conversely, there are concerns related to the human-likeness of service robots, particularly in the hospitality industry. The concept of the uncanny valley suggests that overly human-like robots can lead to discomfort and reluctance in consumer interactions. Compared to human staff, humanoid robots are often perceived as lacking interpersonal skills, which are crucial for customer satisfaction. In instances of service failure, consumers are less likely to accept apologies from robots than from human staff. This dichotomy highlights the need for careful consideration in the design and implementation of humanoid robots in service roles. Hospitality managers, in particular, should be cautious with extremely human-like robots, especially in tasks involving frequent customer interactions, to ensure a positive impact on consumer experience.

Market Outlook for Humanoid Robots in the Service Industry

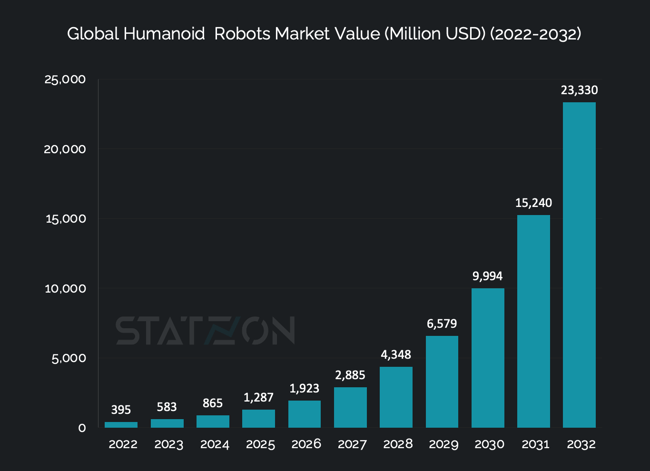

In the realm of service robotics, humanoid service robots (HSRs) are emerging as a pivotal technology, reshaping expectations and capabilities within the industry. The market, valued at approximately USD 395 million in 2022, is on a rapid ascent, with projections indicating a surge to USD 23.3 billion by 2032. This growth trajectory mirrors the swift adoption of transformative technologies like electric and autonomous vehicles, suggesting a bright future for humanoid robots.

Source: Statzon/ Apollo Research Reports

Source: Statzon/ Apollo Research Reports

The initial demand for humanoid robots is predominantly from the industrial sector, with companies like Amazon leading the charge. Their experimentation with humanoid robots such as Digit, developed by Agility Robotics, in warehouse settings, underscores the potential of these robots in logistics. Digit's capabilities in handling repetitive and physically demanding tasks highlight the efficiency and operational improvements humanoid robots can bring to industries grappling with labor shortages.

However, the scope of humanoid robots extends far beyond industrial applications. Research by Goldman Sachs forecasts a $6 billion market for humanoid robots in the next 10 to 15 years, with significant implications for sectors like elderly care. By 2035, humanoid robots are expected to fulfill 2% of the global demand for elderly care, marking a significant step towards integrating these robots into more personal aspects of life.

The home-based market demand for humanoid robots is anticipated to be a critical driver in the market's expansion. Predictions suggest that this demand could propel the humanoid robot market to a staggering $3 trillion by 2050. Visionaries like Elon Musk of Tesla have expressed similar views, especially with the unveiling of Tesla’s humanoid prototype, Optimus. Musk envisions a future where home-based humanoid robots represent a fundamental shift in civilization.

Technological advancements in sectors like electric and autonomous vehicles have significantly influenced the development of humanoid robots. Improvements in sensors, AI chips, and batteries have not only accelerated the development of humanoid prototypes but also made them more accessible and affordable. For instance, Tesla's Optimus, with a projected price of $20,000 per unit, exemplifies the impact of these technological advancements.

Despite the promising outlook, the integration of humanoid robots into dynamic service environments presents challenges. Studies have shown that while humanoid robots are adept at tasks requiring high precision and consistency, their integration into frontline services necessitates a deeper understanding of human-robot interaction dynamics. Additionally, there are concerns about job displacement and the broader societal impact of humanoid workers. In response, companies like Amazon emphasize the creation of new job types and roles as a result of robotic integration, highlighting the evolving nature of the workforce in the era of robotics.

Sources: Statzon, Deloitte, bu.edu, BCG, EY, academia.edu, Macquaire, roboticstomorrow.com, IFR World Robotics 2023